What I Saw Last Week

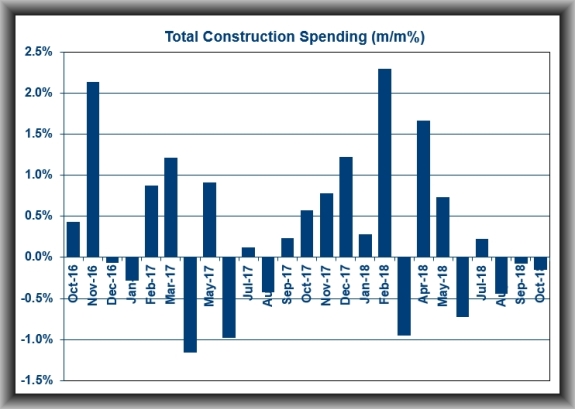

Total U. S. Construction Spending dropped by 0.1% in October following a downwardly revised 0.1% (from 0.0%) in September. I had forecast it to have risen by 0.3%.

Total private construction spending declined 0.4% in October. Residential spending fell 0.5%, led by a 0.5% drop in new single-family construction. Non-residential spending declined 0.3%, led by a 2.4% drop in power spending.

Total public construction spending increased 0.8%. Nonresidential spending jumped 0.7%, driven by a 2.6% increase in educational spending.

Total construction spending was up 4.9% year-over-year in October, with total residential spending up 1.7% and total nonresidential spending up 7.3%.

The takeaway from the report is that the weakness was driven by a decline in new single-family construction, providing further evidence of the softening in housing market activity.

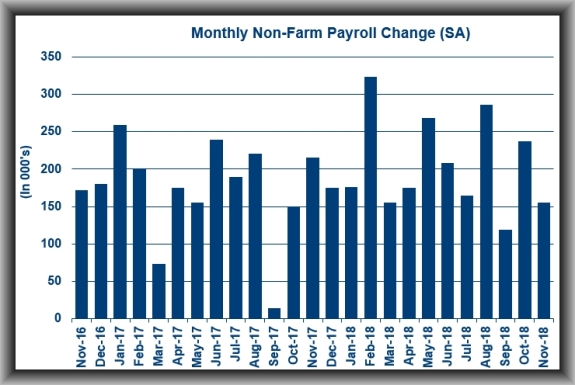

November Non-Farm Payroll growth was lackluster with an increase of 155,000 (I had expected to see an increase of 185,000.)

Over the past three months, job gains have averaged 170,000 per month. October non-farm payrolls revised to 237,000 from 250,000. September non-farm payrolls revised to 119,000 from 118,000.

November private sector payrolls increased by 161,000 with October private sector payrolls revised up to 251,000 from 246,000 and September private sector payrolls revised down to 117,000 from 121,000.

Of note was that average hourly earnings were up 0.2% month-over-month leading to an annual increase of 3.1%

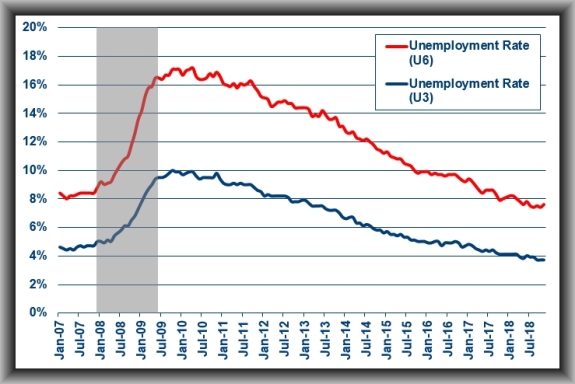

As I had anticipated, the U.S. Unemployment Rate held at 3.7%.

Persons unemployed for 27 weeks or more accounted for 20.8% of the unemployed versus 22.5% in October. The U-6 unemployment rate, which accounts for unemployed and underemployed workers, was 7.6% versus 7.4% in October.

The labor force participation rate was 62.9% in November versus 62.9% in October.

The takeaway from the payroll and unemployment reports is that the wage acceleration the Federal Reserve has been bracing for was missing. That won’t likely keep the Federal Reserve from raising the target range for the fed funds rate at its December FOMC meeting, yet it’s the type of data point that could lead the Federal Reserve to be more cautious-minded about raising rates after that.

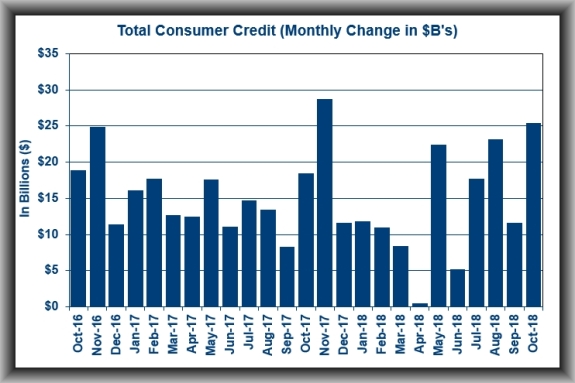

Consumer Credit rose by $25.4 billion in October – I had forecast a rise of $16.5 billion.

Non-revolving credit increased by $16.2 billion to $2.926 trillion while revolving credit increased by $9.2 billion to $1.037 trillion.

Consumer credit increased at a seasonally adjusted annual rate of 7.75% in October, with revolving credit increasing at an annual rate of 10.75% and non-revolving credit increasing at an annual rate of 6.75%.

The takeaway from the report is that the healthy expansion in consumer credit is a good portent for current and future consumer spending activity.

What to Watch for This Week

Inflation – as measured by the Consumer Price Index – in November should show the overall rate unchanged and the core rate up by 0.2%.

U.S. Retail Sales rose 0.8% in October and the November figures should show sales up by 0.2% and core sales (ex-auto) up by 0.3% (from 0.7% the prior month).