What I Saw Last Week

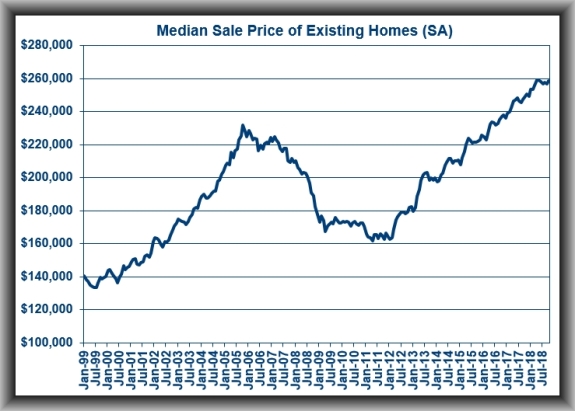

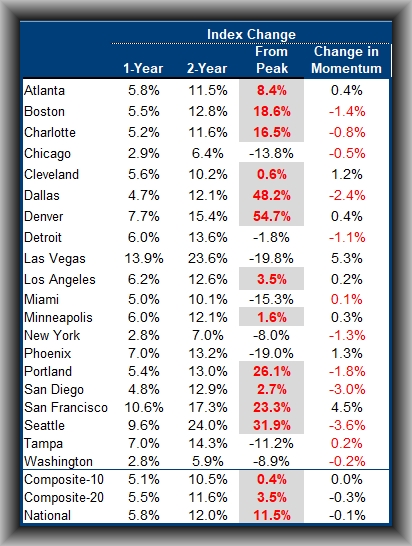

The Case Shiller Index number for September showed the 20-City Index level up by 5.1% year-over-year (I had forecast 5.3%) – down from the August level of 5.5% as rising mortgage rates cut into affordability.

Notably, this growth rate is the lowest seen since November of 2016.

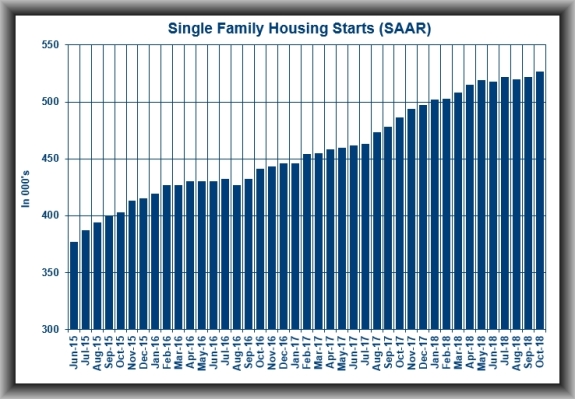

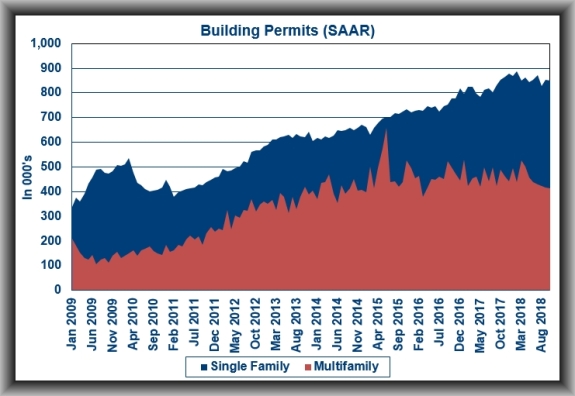

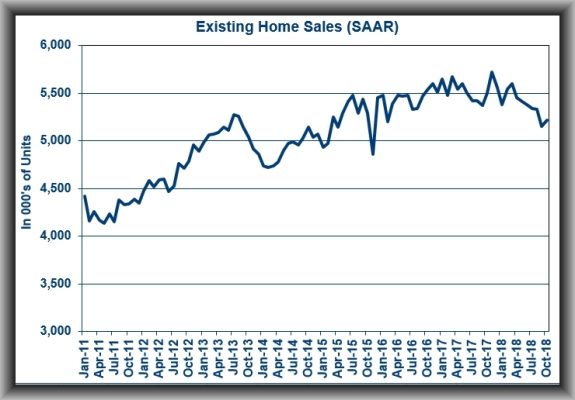

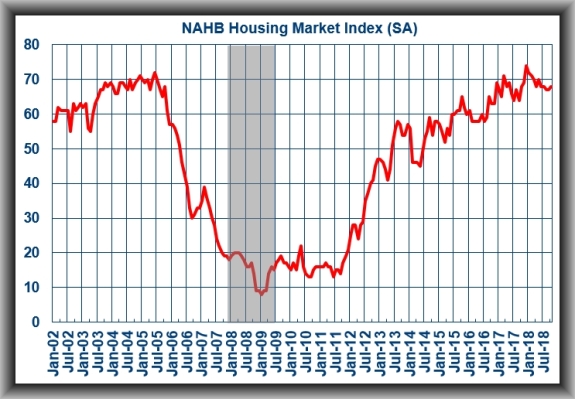

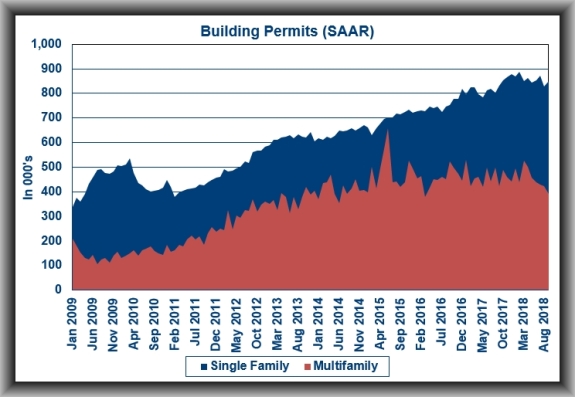

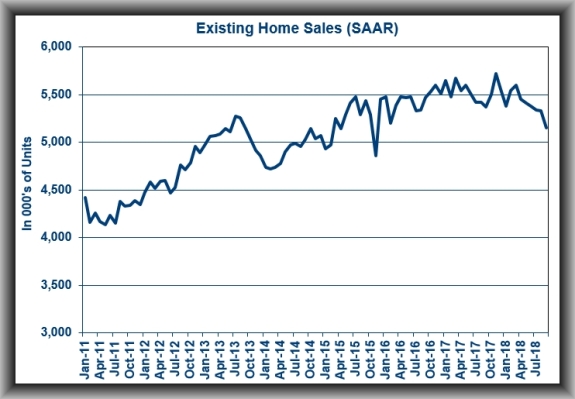

Separately, home prices plus data on house sales and construction also confirm the slowdown in housing. One factor contributing to the weaker housing market is the recent increase in mortgage rates. The average rate on the 30-year fixed mortgage is now a full percentage point higher than it was one year ago, and affordability has fallen to the weakest level in over a decade.

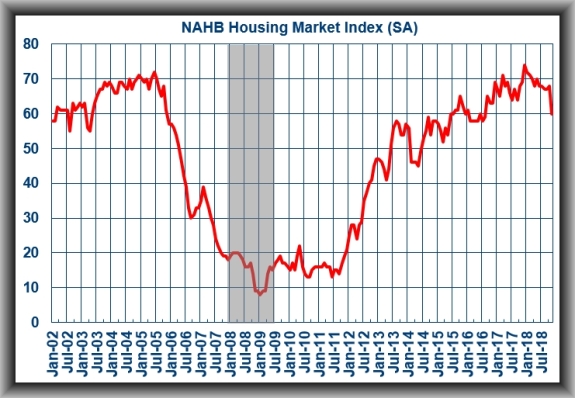

Sales of existing homes are down 9.3% from that peak and housing starts are down 8.7% from November of last year with the National Association of Home Builders sentiment index dropped seven points to 60, its lowest level in two years.

Cities that experienced the biggest price drops during the housing crash a decade ago are still seeing some of the biggest gains currently. Las Vegas, Phoenix and Tampa are still seeing home value gains increase.

Las Vegas, San Francisco and Seattle reported the highest year-over-year gains among the 20 cities. In September, Las Vegas prices jumped 13.5% annually. San Francisco values rose 9.9% and Seattle homes saw an 8.4% increase. Four cities in the 20-City Composite saw bigger annual increases in September than in August.

The takeaway from the report is home price growth is moderating and this trend will continue into 2019.

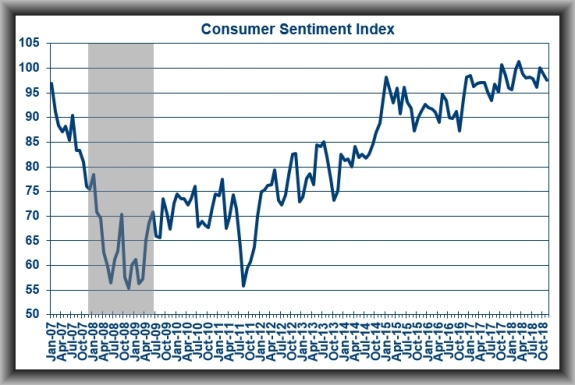

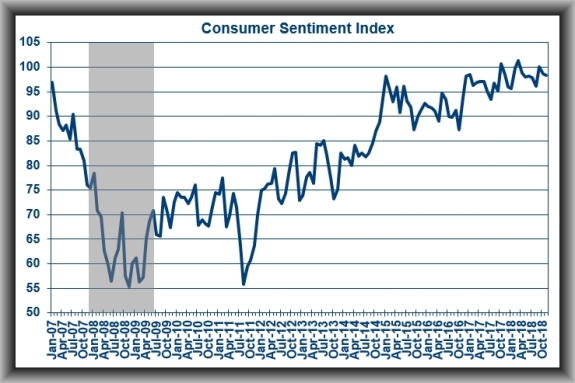

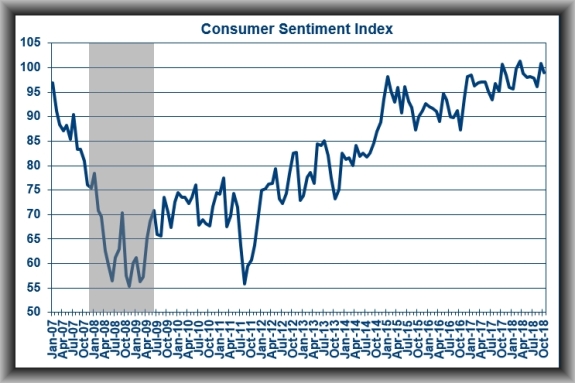

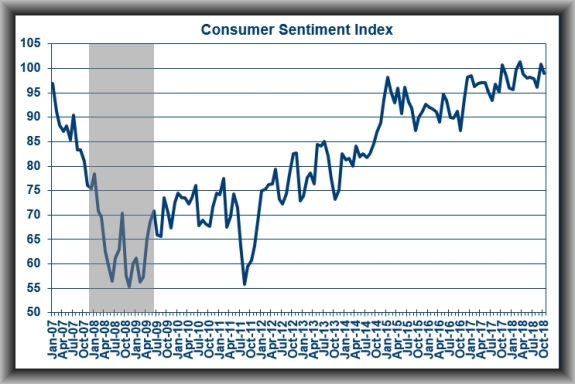

Consumer Confidence in November dipped from 137.9 to 135.7 – I had forecast a drop to 135.5.

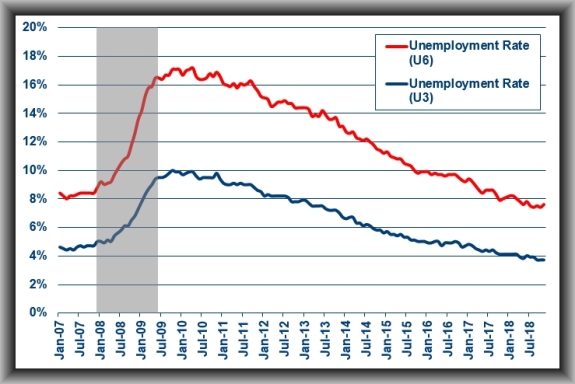

The Present Situation Index increased from 171.9 to 172.7, bolstered by consumers’ assessment of job growth while the Expectations Index fell from 115.1 to 111.0 – pressured somewhat by a less optimistic view of future business conditions and personal income prospects.

The takeaway from the report is that consumer confidence remains at historically strong levels due in large part to positive views on the labor market.

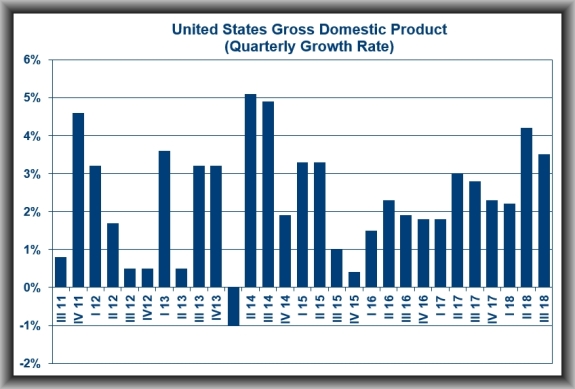

The second estimate for GDP in Q-3 showed economic growth unchanged at an annual rate of 3.5% (I had forecast it to have increased to 3.6%).

Personal consumption expenditures growth was revised down to 3.6% from 4.0% and gross private domestic investment growth was revised up to 15.1% from 12.0%.

Export growth was revised down to -4.4% from -3.5% while import growth was revised up to 9.2% from 9.1%. Net exports subtracted 1.91% from real GDP growth and government spending growth was revised down to 2.6% from 3.3% and contributed 0.44% to real GDP growth.

The takeaway from the report is that real final sales, which exclude the change in inventories, were up just 1.2% – the weakest growth rate since the fourth quarter of 2016.

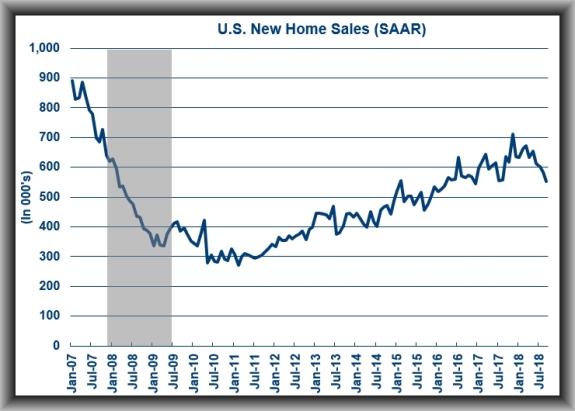

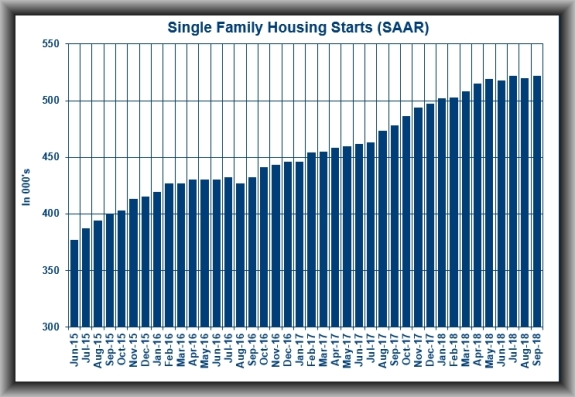

U.S. New Home Sales in October dropped 8.9% to an annual rate of 544,000 as the September figure was revised up to 597,000 (from 553,000). I had forecast an increase to 575,000.

Regionally, new home sales were down 18.5% month-over-month, and 46.3% year-over-year in the Northeast; down 22.1% month-over-month, and 16.7% year-over-year in the Midwest; down 7.7% month-over-month, and down 11.6% year-over-year in the South; and down 3.2% month-over-month, and down 1.3% year-over-year in the West.

At the October sales pace, there is a 7.4 months’ supply of new homes for sale, which is the highest supply level since January 2011. The increase in supply should presumably be a precursor to lower prices that will crimp profit margins for home builders.

The median sales price in October was down 3.1% year-over-year to $309,700 while the average sales price was up 0.3% to $395,000. In what is a likely nod to affordability constraints presented by rising mortgage rates, homes priced at $400,000 or more accounted for 28% of new homes sold in October versus 33% in September.

Regardless of the upward revision to September, the takeaway from the report is that the pace of new home sales is weak across all regions and reflects the affordability constraints fueled by rising mortgage rates. The October sales pace is the slowest since March 2016.

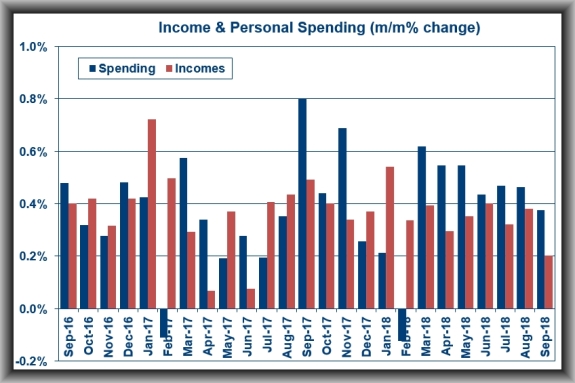

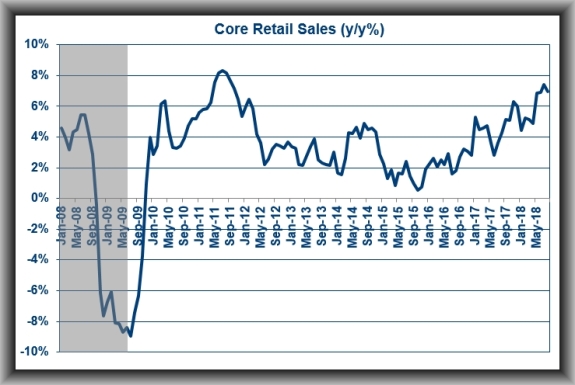

Income & Spending in the U.S. in October showed incomes up by 0.5% (I had forecast 0.4%) and spending up by 0.6% (I had forecast 0.4%).

If there was a drawback on the spending side, it’s that a decent chunk was driven by increased spending for household electricity and gas (i.e. non-discretionary spending).

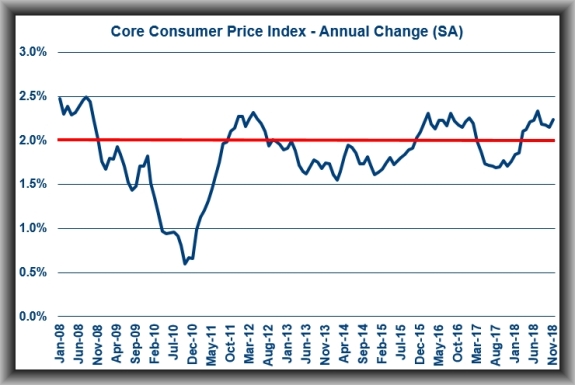

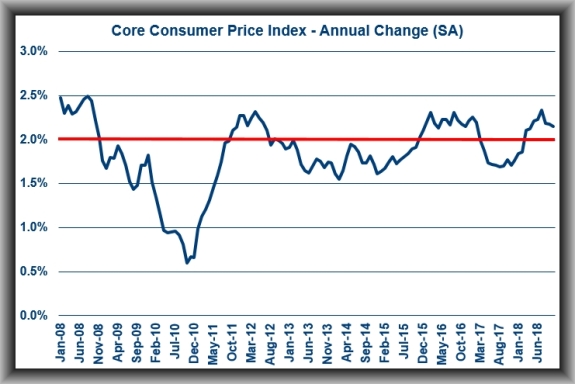

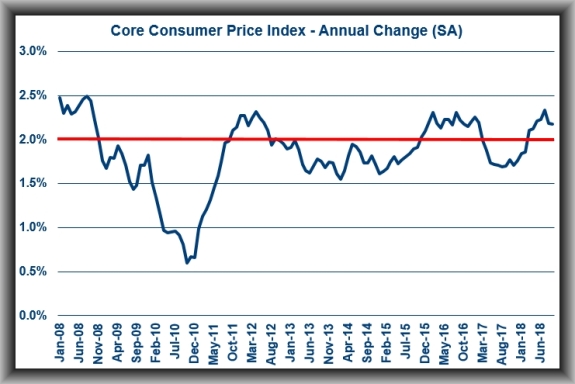

There weren’t any drawbacks on the inflation end of the report – it was tame. The PCE (Personal Consumption Expenditures) Price Index was up 2.0% year-over-year, unchanged from September, and the core PCE Price Index was up 1.8%, down from 1.9% in September.

The increase in personal income in October was driven by a 0.3% increase in wages and salaries, a 0.4% increase in personal income receipts on assets, and government social benefits to persons.

The tame inflation reading is the primary takeaway from the report since it is supportive of the Federal Reserve taking a more deliberate approach to raising the fed funds rate.

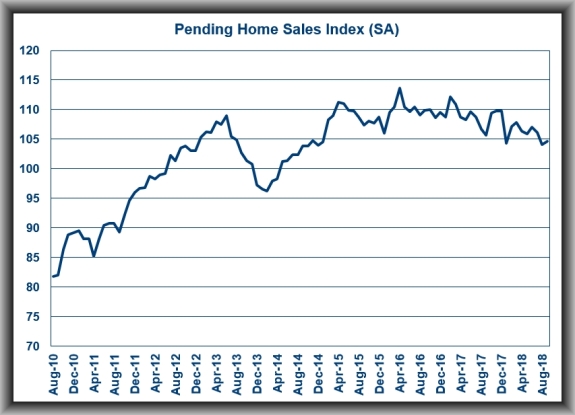

The NAR Pending Home Sales Index for October showed signed contracts down by 2.6% (I had forecast it to have risen by 0.3%).

While all regions saw a decline, pending sales in the West fell furthest, down 8.9% for the month and down 15.3% compared with a year ago. Sales in the Northeast rose 0.7% for the month and were 2.9% lower annually. In the Midwest, sales fell 1.8% monthly and 4.9% annually. Sales in the South were 1.1% lower monthly and 4.6% lower than a year ago.

One bright spot in the market is an increase in supply, especially in markets where supply had been tightest and demand highest. Denver, Seattle, San Francisco and San Diego saw some of the largest increases in listings in October, compared with a year ago.

The takeaway of the report is to underscore the challenges as elevated prices and rising mortgage rates are keeping more Americans on the sidelines of the housing market. I consider pending-home sales a leading indicator because they track contract signings; purchases of existing homes are tabulated when a deal closes, typically a month or two later.

While the report is in line with the view that housing isn’t expected to collapse, the industry may have trouble gaining traction. As discussed above, previously-released data on new home sales showed a drop in October to the weakest pace since March 2016, while purchases of previously owned houses rose for the first time in seven months.

What to Watch for This Week

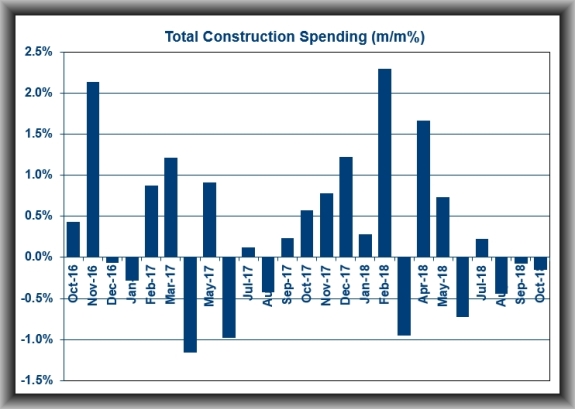

U.S. Construction Spending was little changed in September and I am looking for the October number to be an improvement with total spending up by 0.3%.

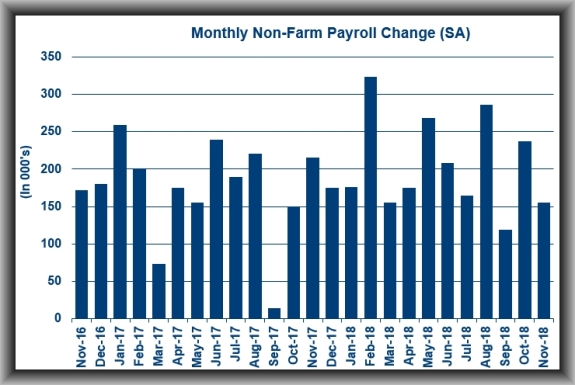

U.S. Non-Farm Payrolls rose by 250,000 on October and the November numbers should show the country having added 185,000 new jobs.

The U.S. Unemployment Rate will remain at 3.7%.

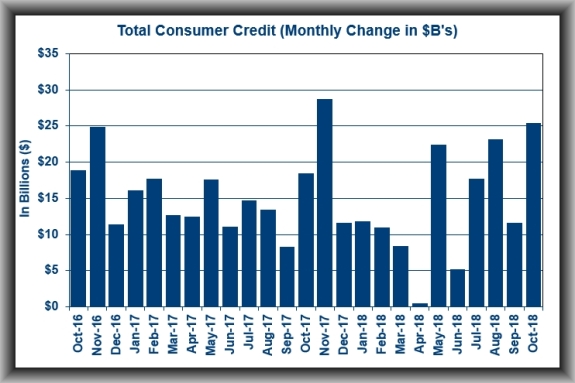

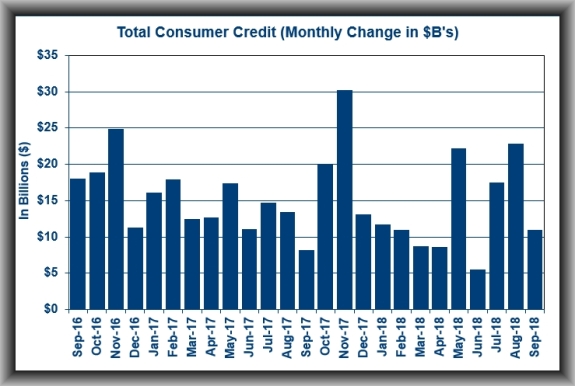

Consumer Credit rose by $11 billion in September and the October figure should show credit expanding by an additional $16.5 billion.